Photography & Lighting Equipment

Showing all 24 results

-

AmazonBasics Camera Backpack

Buy product -

B+W 72 mm Clear UV Haze

Buy product -

Canon 1DX Mark II

Buy product -

Canon 5D Mark III

Buy product -

Canon 5D Mark IV

Buy product -

Canon 70-200 mm Telephoto Lens

Buy product -

Canon EF 100 mm f/2.8 Lens

Buy product -

Canon EF 12 II Extension Tube

Buy product -

Canon EF 50 mm f/1.2 Lens

Buy product -

Canon Speedlite Flash

Buy product -

Clamp Holder

Buy product -

Heavy Duty Light Stands

Buy product -

Large Softbox

Buy product -

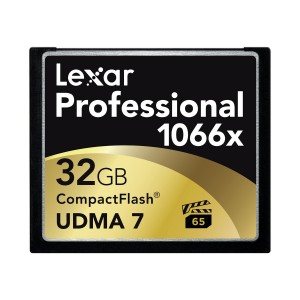

Lexar Flash Card

Buy product -

Manfrotto Boom Stand

Buy product -

Manfrotto Junior Geared Head

Buy product -

Manfrotto Monopod Head

Buy product -

Manfrotto MT055XPRO3 Tripod

Buy product -

Manfrotto Rapid Adapter

Buy product -

Neewer Studio Reflector

Buy product -

Small Softbox

Buy product -

Studio Flash Light

Buy product -

Video Light

Buy product -

Video Light Softbox

Buy product